Debt Investment for Startups

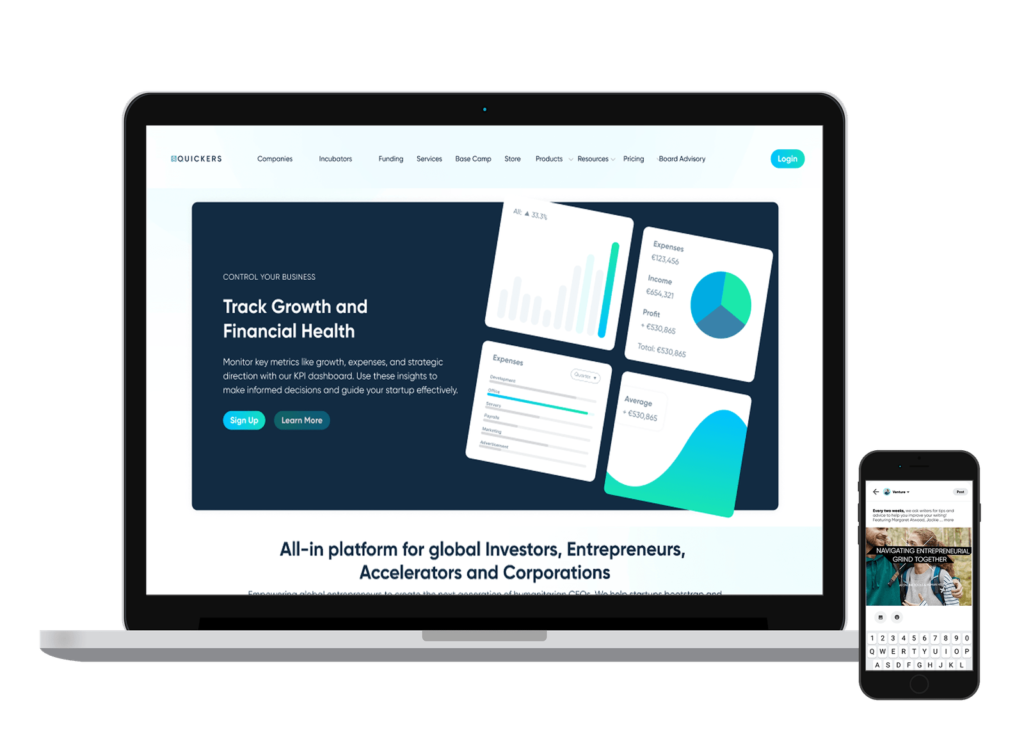

At Quickers Tech, we help entrepreneurs navigate the complexities of startup debt financing. Our AI-powered platform and expert advisors provide the structure, tools, and confidence you need to secure funding, manage repayment, and scale sustainably.

Key Benefits of Quickers' Debt Financing Support

Our platform simplifies debt investment processes, saving you time and increasing productivity, so you can focus on business growth.

Customized Debt Financing

Tailor your funding journey with flexible debt instruments aligned with your business model, growth stage, and cash flow.

Debt Financing Workflow

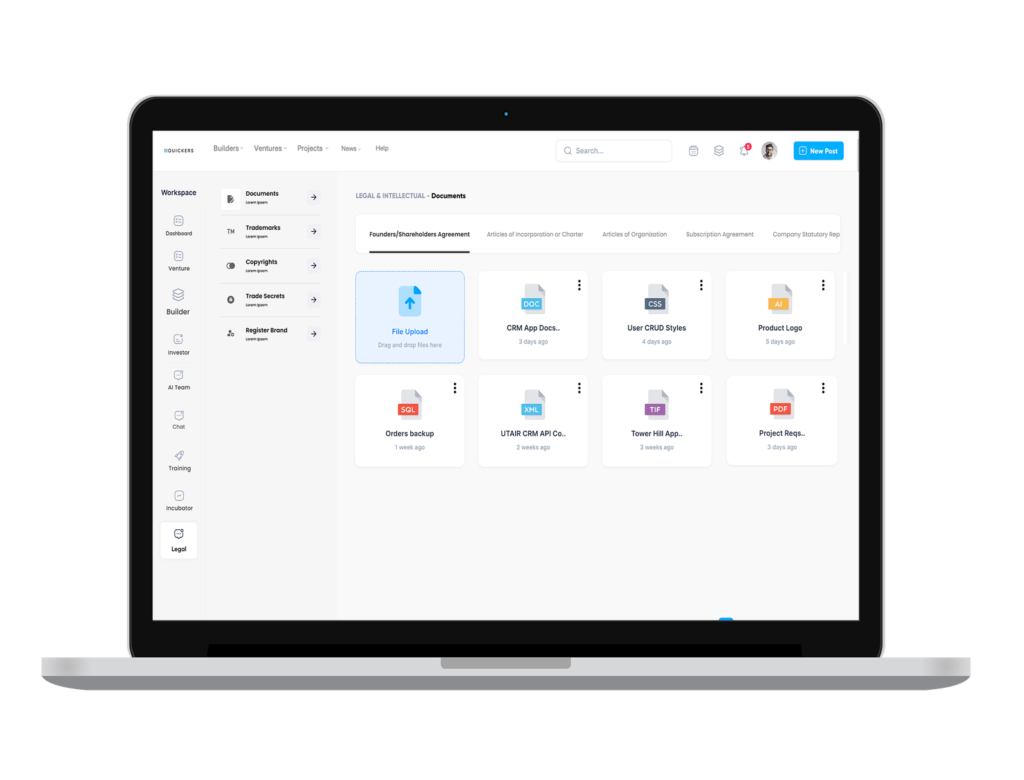

Integrate our tools into your existing financial systems to streamline loan applications, documentation, and investor communication.

Debt Investment Guidance

Work with financial experts who understand startup capital needs, loan structuring, and venture debt management.

Empower Your Startup's Debt Financing Journey

Quickers offers a comprehensive, tech-enabled process to secure and manage debt financing, backed by AI, automation, and experienced advisors.

Application

Upload your startup data and receive automated analysis to assess funding readiness and risk profile.

Loan Structuring & Compliance

Choose from flexible loan formats including term loans, lines of credit, or revenue-based financing secured with blockchain-based compliance and digital contracts.

Investor Matchmaking

Our AI tools match your startup with vetted lenders and alternative debt investors aligned with your risk-return profile.

Approval, Disbursement & Repayment

Manage the entire lifecycle of your loan from approval to structured repayments, all in one seamless platform.

Turn Strategic Debt Into Scalable Growth

Our solutions help startups use debt not just as capital but as an innovative lever for expansion and financial resilience.

Series Seed to Series A & Beyond

Whether you’re pre-revenue or post-product-market fit, we support startups at all stages with tailored debt solutions.

Optimized Financial Modeling

Refine your projections with AI-recommended financial models and use them to support successful negotiations and lender trust.

Blockchain-Backed Compliance

Protect your sensitive documents with secure storage, traceable transactions, and digital audit trails.

Lender Certification

Complete our debt financing process and receive a “Trusted Borrower” certification, which will boost your credibility for future loans.

Transforming Debt Financing into Business Growth

Loan Disbursement

Quickers assists in managing loan disbursements, ensuring funds are allocated effectively to support your business growth strategies.

Repayment and Beyond

Our platform provides tools to help you monitor and manage repayments efficiently, ensuring sustainable financial health for your business.

Key Features of Quickers’ Debt Financing Platform

Our platform offers a variety of versatile, usable features to support debt financing.

Complete End-to-End Debt Investment Journey

From financial assessment to lender engagement, we support your entire debt financing lifecycle with AI-powered insights.

AI-Powered Risk & Growth Forecasting

Identify funding gaps, calculate repayment capacity, and project long-term outcomes using machine learning models.

Structured Loan Options Tailored to Startups

Choose from venture debt, convertible notes, working capital loans, and other startup-appropriate instruments.

Fundraising Support

Get hands-on support to manage fundraising campaigns, bridge rounds, or hybrid funding models combining debt and equity.

Lender & Investor Marketplace

Access a curated network of institutional lenders, angel debt investors, and fintech partners, matched via AI-driven algorithms.

Investor Connections

Quickers connects businesses with debt investors through AI-driven matchmaking, facilitating a secure funding process with blockchain-backed transparency.

1. What is Debt Investment, and how does it differ from equity investment?

Debt Investment involves raising funds by borrowing money from investors or institutions, which must be repaid with interest. Unlike equity, it doesn’t involve giving up ownership. Quickers Tech helps structure, manage, and secure debt financing suited to your business model and growth stage.

3. Why should a startup consider debt investment?

Debt investment is great when: You want capital without diluting equity You have predictable revenue You need short-to-mid term funds for scaling We help identify if debt is right for you and connect you with suitable lenders or investors.

5. Do you help with the negotiation of loan terms?

Yes. Our experts help negotiate: Interest rates Repayment schedules Grace periods Covenants and penalties We ensure the deal protects your cash flow and business flexibility.

7. What documents are required for debt funding?

You’ll typically need: Financial statements Business plan Loan agreement Debt covenants Personal guarantees (sometimes) We assist in preparing and digitizing all required documentation.

9. Can I take both debt and equity investment?

Yes! Many startups use a hybrid funding strategy to balance growth and ownership. We help structure and manage both types, ensuring transparency with your investors and advisors.

2. What are the types of debt instruments you help with?

We support: Convertible notes Term loans Revenue-based financing SAFE with debt-like features Venture debt Quickers Tech customizes solutions based on your needs and risk profile.

4. How does Quickers Tech support the debt funding process?

We offer: Financial health and risk assessment Investor and lender matchmaking Custom repayment planning Legal documentation Debt management tools This ensures a smooth and responsible borrowing experience.

6. Can Quickers Tech help with venture debt?

Absolutely. We guide you through: When venture debt is appropriate Which venture debt firms to approach How to balance it with equity This is especially helpful post-Series A or when raising a bridge round.

8. How is debt investment repaid?

Repayment depends on the loan type, but it usually involves: Monthly or quarterly payments Revenue-based paybacks (for flexible loans) Balloon payments or lump sums (for short-term instruments) We help set up a custom repayment model and tracking dashboard.

10. How can I start the debt funding process with Quickers Tech?

Book a discovery call or contact us through our website. We’ll review your financials, suggest the best debt funding options, and support you from lender matching to loan management.

Debt Financing for Industry-Level Innovation

Beyond startups, Quickers powers industry leaders with AI-driven SaaS tools for debt management. From finance to healthcare and e-commerce, our lean IT and predictive analytics help enterprises: