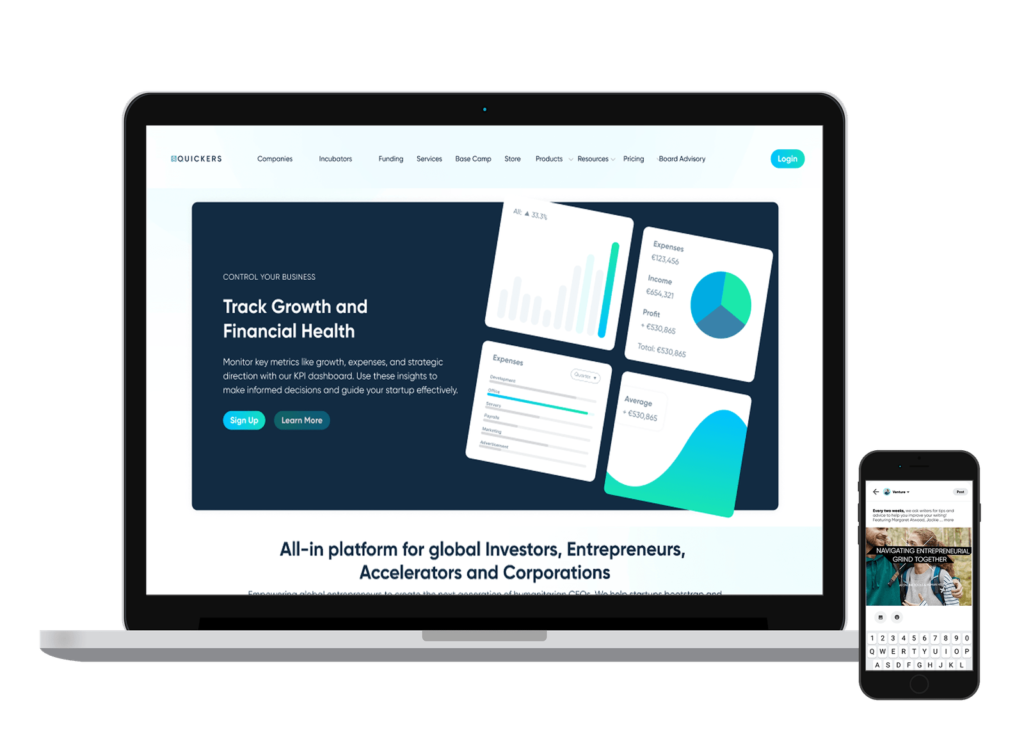

Your Investment Journey with Innovative Tools

Quickers simplifies equity investment, helping entrepreneurs connect with investors, manage funding, and drive growth. Start building your venture’s financial future today!

Key Advantages

Our platform streamlines your investment process, enhancing transparency, saving you time, and maximizing funding opportunities.

Investment Strategies

Adapt your investment approach with tools tailored to meet your specific equity goals.

Effortless System Integration

Integrate seamlessly with your current financial systems for streamlined investment management.

Investment Support

Receive expert guidance on equity structuring, investor relations, and navigating the investment process.

Empower Your Investment Journey from Seed to Success

Initial Setup

Quickers’ Equity Investment platform helps you prepare for attracting investors by providing tools to build a compelling business case. Whether you’re raising funds for a startup or expanding an existing business, our platform ensures you’re investment-ready.

Equity Structuring

We guide you through the process of structuring your equity deals, ensuring the right valuation and equity split that appeals to investors while maintaining your business control.

Investor Pitching

Craft a winning pitch with our investor engagement tools. From pitch decks to financial projections, we provide the resources you need to present your business effectively.

Investment Opportunities with Strategic Insights

Engagement & Negotiation

Quickers supports you through the negotiation process, helping you navigate term sheets, funding agreements, and investor expectations. Our platform ensures you’re well-prepared for every phase of the investment cycle.

Capital Management

Manage incoming capital effectively, track investments, and ensure your financials remain transparent. With Quickers, capital management becomes seamless, giving investors and founders peace of mind.

Ongoing Reporting and Communication

Maintain investor relations with up-to-date financial reports, KPIs, and progress updates, all powered by AI analytics to ensure data-driven decisions and growth.

Transforming Innovative Ideas into Funded Businesses

Post-Investment Growth Management

After securing equity investments, our platform helps you scale your business while keeping investors engaged through regular performance updates and clear communication channels.

Series A and Beyond

Quickers supports your business through subsequent funding rounds, including Series A, B, and beyond, helping you attract larger investments and expand your operations globally.

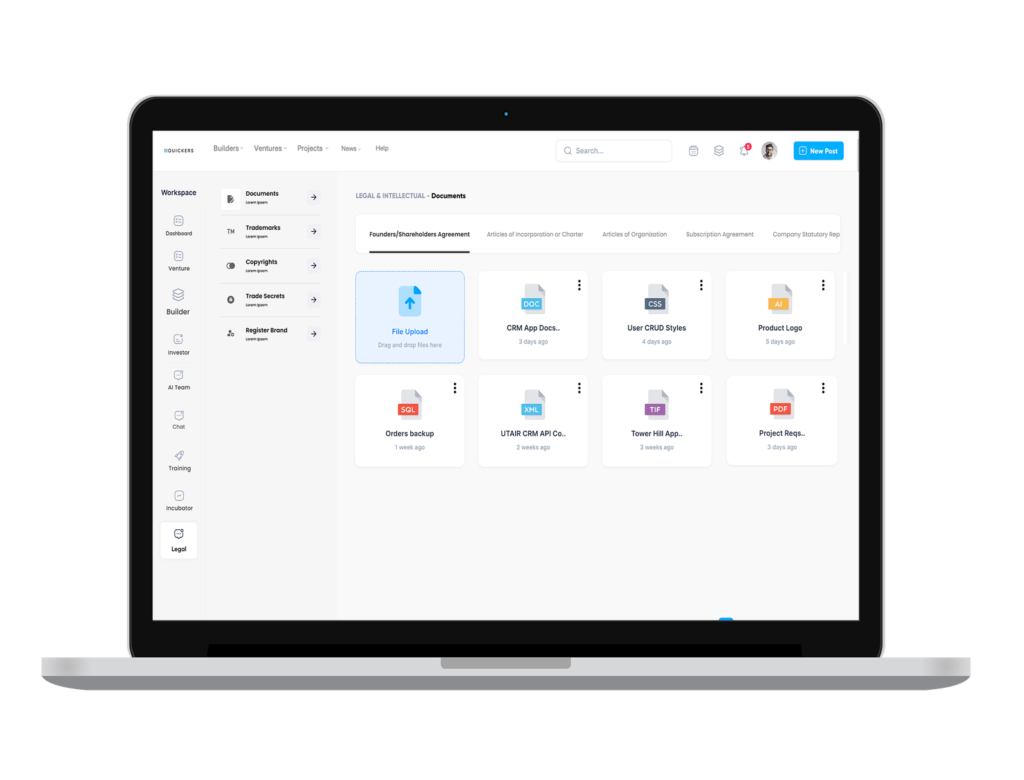

Features List

We provide a wide array of Usable & Flexible Features designed to attract, manage, and optimize your equity investments

Complete Investment Journey

Quickers offers a structured and comprehensive investment journey, from seed funding to Series A and beyond. Powered by AI and Web 3.0, we ensure your business is prepared to attract, manage, and scale investment opportunities.

Smart Equity Deals

Our platform utilizes blockchain technology to secure your equity deals, ensuring transparency, immutability, and trust in your financial agreements. This creates a seamless experience for both founders and investors.

Investor Relations Management

Quickers offers investor relations tools to manage communication, financial updates, and performance metrics. Keeping your investors engaged and informed has never been easier.

Investor Readiness Certification

Graduating from our program provides you with an “Investor-Ready” certification, validating your startup’s potential and attracting investors with confidence.

Capital Allocation & Management

Our platform ensures effective allocation and management of raised capital. You can track, report, and optimize your funding utilization for maximum growth.

Investor Matchmaking

Powered by AI, Quickers helps match startups with the right investors, facilitating mutually beneficial partnerships.

1. What is Equity Investment, and how does it work for startups?

Equity Investment involves raising capital by selling a percentage of ownership in your company to investors. In return, investors receive shares and a stake in your future success. Quickers Tech supports startups through every step — from preparing your business to managing the equity post-investment.

3. Who are typical equity investors?

They include: Angel investors Venture Capital (VC) firms Accelerators and incubators Corporate investors Quickers Tech helps you identify and approach the right investors for your business stage and industry.

5. How much equity should I offer to investors?

It depends on your startup's valuation, funding needs, and long-term goals. We help you determine a fair equity offer using tools like: Valuation models Dilution simulations Cap table analysis

7. What legal documents are required for equity funding?

Key documents include: Shareholder agreement Term sheet Subscription and investment agreements Quickers Tech simplifies and digitizes the process through templates, expert support, and e-signature tools.

9. Do you help with post-investment reporting and compliance?

Definitely. We assist with: Investor reporting templates Performance dashboards Governance updates These keep investors informed and build trust throughout your growth journey.

2. How can Quickers Tech help me raise equity investment?

We assist with: Pitch deck and valuation preparation Financial forecasting and cap table structuring Investor outreach and matchmaking Legal documentation and term sheet setup Our goal is to help you raise capital while maintaining control and clarity.

4. What are the benefits of equity investment over loans or debt?

Equity investment: Doesn’t require repayment Shares risk with investors Brings in strategic partners Enables long-term scaling It’s ideal for high-growth startups looking to scale fast without cash flow pressure.

6. Will I lose control of my company if I raise equity investment?

Not necessarily. With the right terms and shareholder agreements (which we help prepare), you can retain decision-making control while sharing ownership. We help you structure investment deals that protect your vision and leadership.

8. Can I track and manage investor equity through your platform?

Yes. We offer tools to help you: Manage your cap table Track share allocations Handle equity updates and transfers All securely managed in one place.

10. How do I start my equity investment journey with Quickers Tech?

Reach out to us via our website. We’ll evaluate your business readiness, structure a fundraising plan, and guide you through the entire equity investment process — from pitch to close.

Equity Investment Strategy

We develop lean, scalable, and intelligent AI-powered SaaS solutions to optimize industries. Our expertise in generative AI for automation, content creation, and predictive analytics enhances efficiency, eliminates waste, and supports data-driven decision-making. By leveraging lean IT principles, we streamline processes, reduce complexity, and drive continuous innovation in sectors like finance, healthcare, and e-commerce.