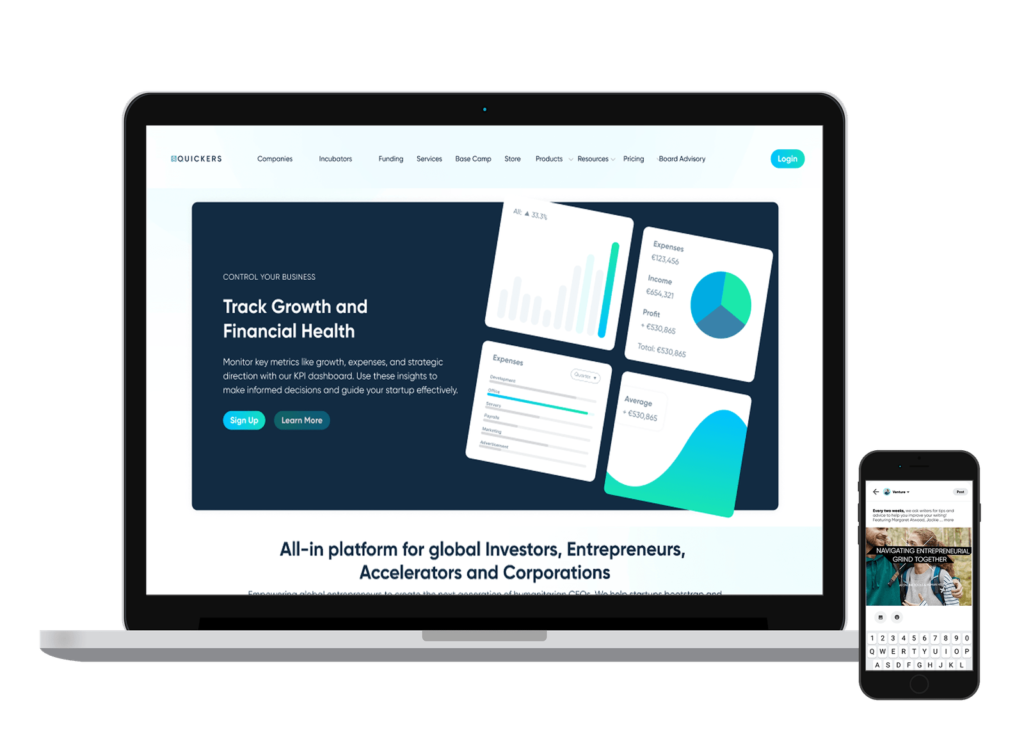

Portfolio Management Software

Quickers’ SaaS platform simplifies portfolio management and creation for startups and complex projects. With powerful investment KPIs and advanced evaluation tools, you can effortlessly analyze and enhance your portfolio, driving greater success and growth.

Key Advantages

Master Your Venture Portfolio: Streamline, Analyze, and Excel

Portfolio Management

Centralize and simplify your portfolio management on a single platform

AI-Driven Insights

Leverage AI advanced analytics and KPIs for informed decision-making.

Collaboration

Collaborate with peers to craft a dynamic and diversified investment portfolio

Startup Feedback™

Direct Feedback Channels

Portfolio managers can use Quickers Venture to send direct feedback to startups during the business planning phases or after milestone evaluations or investor meetings, helping them refine their strategies and operations.

Performance Reviews

Regular performance reviews can be conducted through the platform, allowing for structured feedback sessions that help startups align better with market expectations.

Touchpoint Webinars

Host webinars where portfolio managers share insights on common pitfalls and success strategies, providing collective feedback to multiple startups simultaneously

Evaluator Tool™

Idea Screening

Share early-stage ideas with a selected group of investors and mentors to obtain initial reactions and suggestions, helping to shape the concept before further development.

Mentor Feedback Sessions

Organize sessions where mentors can provide detailed evaluations on business models, market viability, and scalability, offering startups valuable insights.

Evaluate Several Areas

Investors, mentors, and program managers at early stages can assist in evaluating the go-to-market strategy, capitalization, innovation, and other critical startup variables

Relocation and talent Management

Overview

Understanding the valuation of ideas and businesses is crucial for effective portfolio management. Quickers Venture provides tools to assess valuation and manage the talent pool, including reallocating founders to new projects if needed.

Dynamic Valuation Tools

Utilize built-in valuation calculators that consider various metrics and market conditions to estimate the worth of startups, aiding in investment decisions.

Founder Reallocation

In cases where a project may not meet its objectives, Quickers facilitates the process of reallocating founders to other projects where their skills can be better utilized, maximizing resource efficiency and supporting career growth.

Features List

Empower portfolio management with advanced tools for automated building, real-time KPI tracking driving success in the startup ecosystem

Smart Portfolio Builder

The Smart Portfolio Builder automates portfolio creation, selecting startups based on key metrics and strategic goals with algorithm-driven selection, customizable filters, and scenario planning.

KPI Tracker

The KPI Tracker enables portfolio managers to monitor essential performance indicators across startups with real-time insights. It offers live tracking, customizable dashboards to highlight relevant KPIs, and automated alerts for key metric changes.

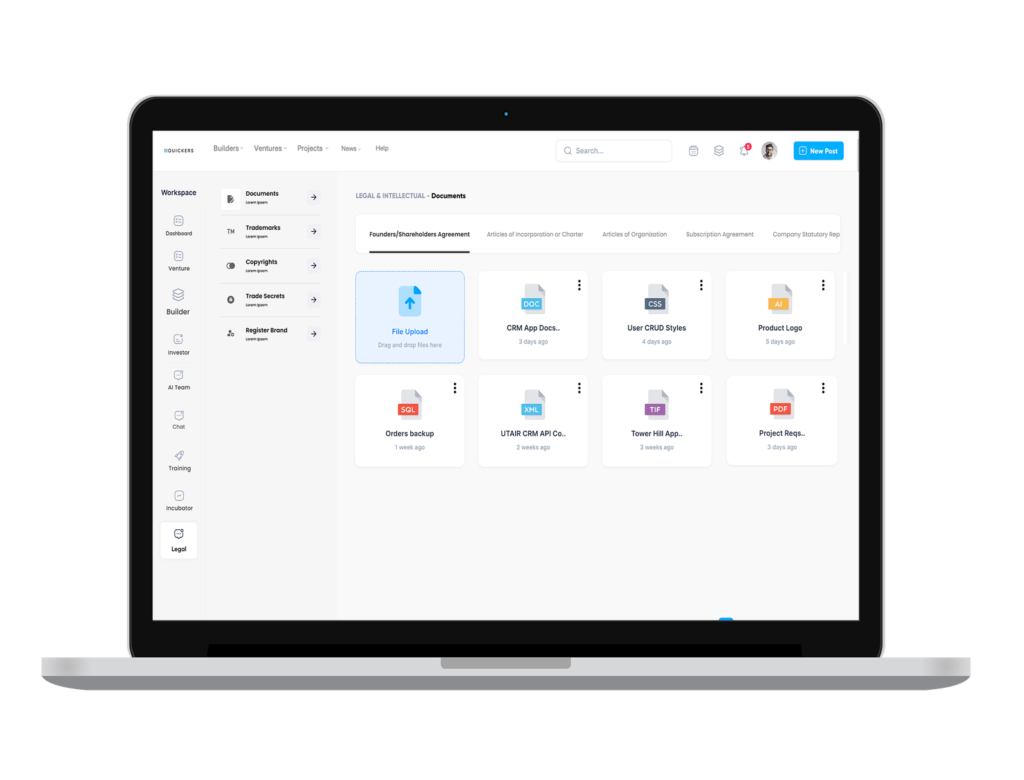

Communication Hub

The Integrated Communication Hub centralizes communication between portfolio managers, startups, and investors, enhancing collaboration with centralized messaging, secure document sharing, and scheduled updates for consistent communication.

Portfolio Certification

Graduating from our program certifies your startup as “Investible,” signaling readiness for external investments with risk scoring, scenario analysis, and mitigation strategies in place

Exit Strategy Planner

The Exit Strategy Planner helps optimize exit strategies to maximize returns by offering market timing insights, scenario comparisons, and stakeholder alignment.

Investor Connections

The Advanced Analytics Suite provides deep data analysis tools, offering insights into portfolio performance and market trends with data visualization, predictive analytics, and custom reports.

1. What is Portfolio Management in a startup or investment context?

Portfolio Management involves tracking, analyzing, and optimizing a group of investments or startups to maximize performance and returns. Quickers Tech offers intelligent tools and advisory to help startups, VCs, and angel investors manage their holdings with clarity and control.

3. What features does your portfolio management platform offer?

Quickers Tech offers: Live performance tracking Valuation updates Equity & cap table insights Milestone and KPI tracking Automated investor reports All in one clean, user-friendly interface.

5. How do you help improve the performance of my portfolio?

We provide: Data-driven insights Custom alerts and projections Recommendations for exits, follow-on investments, or pivots You can also schedule strategy sessions with our experts to fine-tune your portfolio decisions.

7. Do you support integration with other tools or CRMs?

Yes, we support integrations with: Accounting software (like QuickBooks, Xero) CRM tools (like HubSpot, Zoho) Startup ecosystems (like AngelList or PitchBook) We ensure seamless data flow across platforms.

9. Is this useful for preparing investor reports?

Definitely. Our system lets you generate beautiful, automated reports with real-time metrics, valuation updates, and milestones — perfect for quarterly updates or board meetings.

2. Who is your Portfolio Management service designed for?

Our services are ideal for: Startup founders managing multiple ventures Angel investors or VCs monitoring their investments Accelerators or incubators managing cohorts Family offices or investment firms We provide tailored dashboards and analytics for each type of client.

4. Can I track equity and fundraising rounds within the platform?

Yes! We offer full cap table integration and support for tracking: Rounds (Seed, Series A, etc.) Equity splits and dilution Investor ownership Convertible notes and SAFEs Helping you stay funding-ready and transparent.

6. Can I manage financial and non-financial metrics?

Absolutely. Track both: Financials (revenue, burn rate, runway, ROI) Operational KPIs (customer growth, product milestones, team size) Everything is customizable based on your specific goals.

8. Can multiple stakeholders access the portfolio dashboard?

Yes. You can create secure, role-based access for: Co-founders Investors Advisors Internal teams This helps maintain collaboration while protecting sensitive information.

10. How do I get started with Quickers Tech’s Portfolio Management services?

Just contact us through our website or book a free consultation. We'll review your investment landscape or startup needs and onboard you onto a powerful portfolio dashboard tailored to your goals.

Smart Portfolio Management

We develop lean, scalable, and intelligent AI-powered SaaS solutions to optimize industries. Our expertise in generative AI for automation, content creation, and predictive analytics enhances efficiency, eliminates waste, and supports data-driven decision-making. By leveraging lean IT principles, we streamline processes, reduce complexity, and drive continuous innovation in sectors like finance, healthcare, and e-commerce.