Cap Table Management for Startups

At Quickers Tech, we understand that your cap table is more than a spreadsheet; it’s the foundation of your startup’s ownership strategy, decision-making power, and fundraising potential. With our intuitive tools and expert guidance, we help you manage, optimize, and secure your equity structure so you’re always investor-ready.

Key Advantages of Quickers Cap Table Solutions

More than just numbers; it’s a reflection of your startup’s journey.

Online Equity Management

Gain real-time visibility into your startup’s equity distribution. Know who owns what, track every transaction, and stay investor-ready with precision and confidence.

Quick Legal-Tech

Whether you’re issuing shares, managing employee stock option plans (ESOPs), or preparing for a fundraising round, you’ll have the legal tech tools and expert insights to make informed, compliant decisions.

Collaborative Support

Work closely with startup, legal, and venture capital experts who guide you through every stage of your cap table management journey.

Core Elements of a Startup Cap Table

Your Cap Table is a live, strategic tool. We help you manage every key component with clarity:

Equity Ownership Breakdown

Maintain a clear record of all equity owners, including founders, investors, and employees. Track ownership percentages and stay informed of how each stakeholder’s equity evolves over time.

Share Classes (Common, Preferred, SAFEs)

Manage multiple equity types with clarity, including founder shares, investor preferences, and convertible SAFEs.

Dilution Forecasts & Scenario Modeling

Simulate future funding scenarios to understand ownership impact and plan strategic decisions.

Funding Round Planning

Prepare for investor rounds with clear equity allocation, valuation insights, and cap table projections.

Tokenized Equity & Web3 Compatibility

Enable blockchain-based equity with smart contracts, tokenization, and Web3 wallet integration.

Exit Planning & Liquidity Event Forecasts

Forecast shareholder returns across exit strategies like IPOs, acquisitions, or secondary sales.

Transform Ideas into Fundable Startups

Funding Rounds

With Scrum, your team can work more collaboratively and efficiently. Regular check-ins, sprint reviews, and retrospectives ensure that everyone stays aligned, issues are addressed quickly, and the project keeps moving forward. It’s all about keeping the momentum going.

Exit Planning

Even the best-laid plans need monitoring. Using PMBOK best practices, you can keep a close eye on your project’s progress, manage risks, and ensure quality. It’s like having a safety net that catches potential problems before they become bigger issues.

Tokenized Equity

When the project is done, take a moment to celebrate (you’ve earned it!). But also take the time to evaluate what went well and what could be improved. This reflection is crucial for learning and growth, setting you up for even greater success in your next project.

Transforming Innovative Ideas into Thriving Businesses

Liquidity Events Planning

Prepare for liquidity events with confidence, knowing your cap table is ready to support strategic exits, mergers, or public offerings.

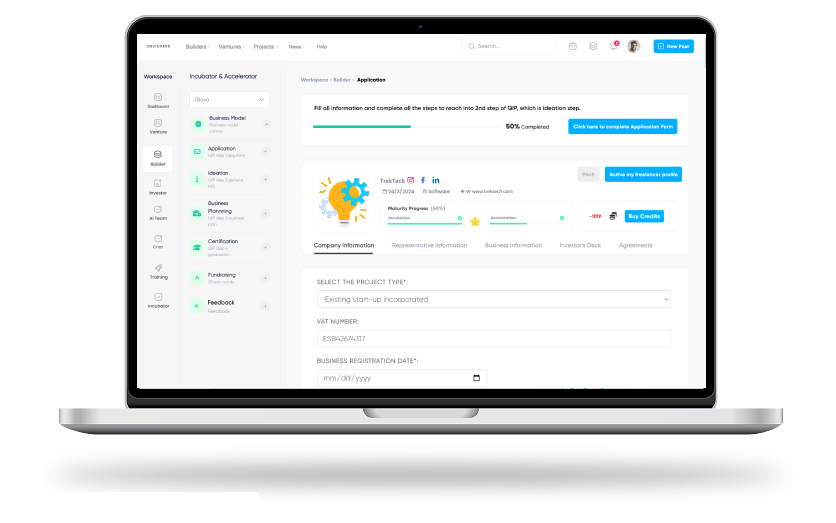

Features: Powerful Cap Table Management Tools

A Comprehensive Suite of Cap Table Management Tools

Blockchain-Based Security

Your equity data is safeguarded with blockchain encryption and real-time updates to ensure tamper-proof ownership records.

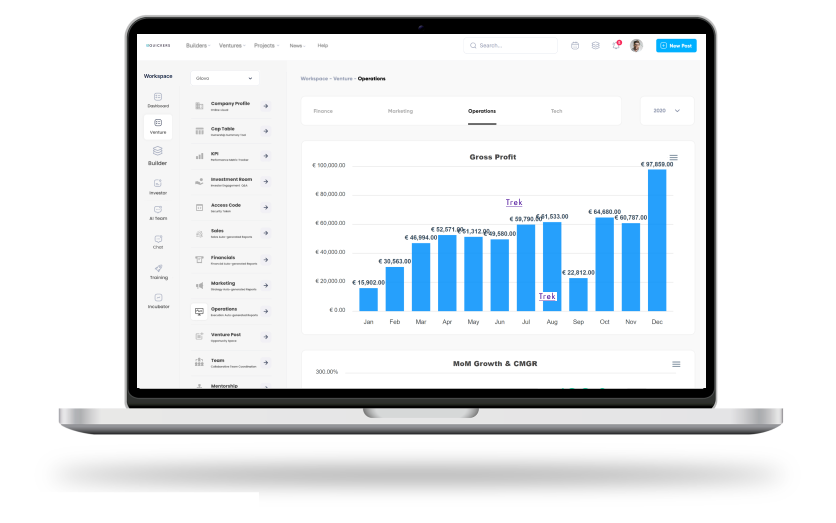

Scenario Modeling

Simulate future investment rounds, employee equity allocations, or exits to understand their effect on ownership and control.

AI-Powered Insights

Receive intelligent recommendations to optimize share structures, dilution management, and investor terms all powered by machine learning.

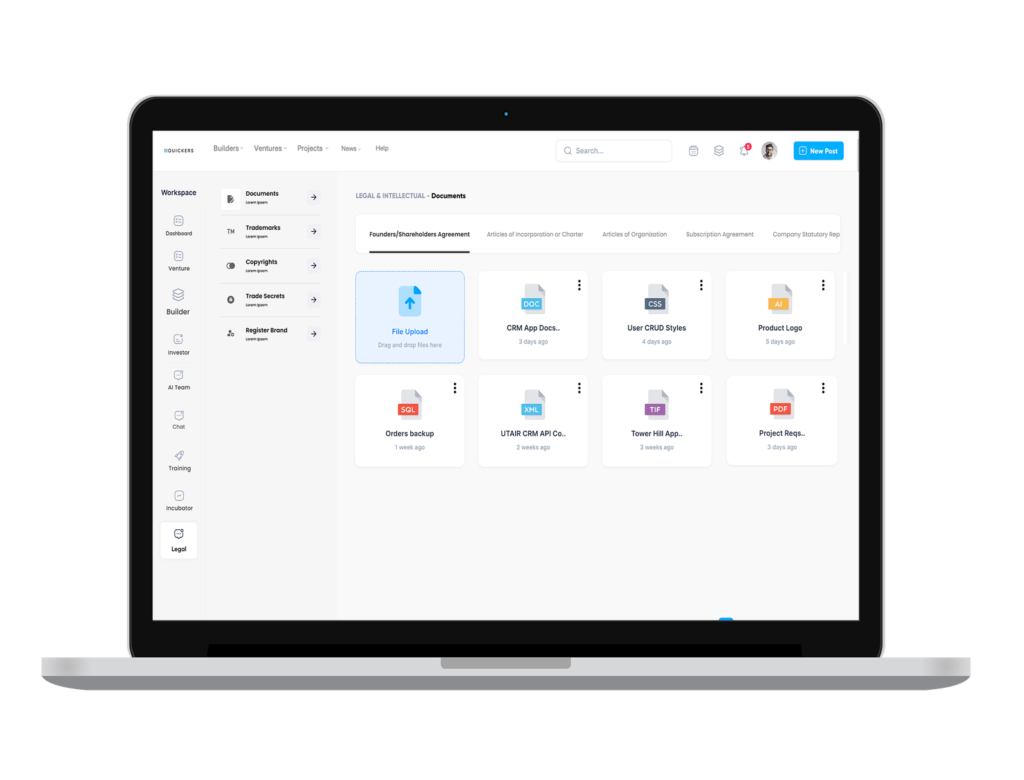

Document Storage

Store and manage critical cap table documents like term sheets, share purchase agreements, and ESOP contracts all in one secure place.

Automated Stakeholder Reports

Generate clear, customized reports for founders, team members, and investors — no spreadsheets required.

Compliance & Regulatory Support

With built-in legal support and reporting tools, you can stay compliant with global equity laws, including GDPR and SEC regulations.

1. What is a Cap Table, and why is it important for startups?

A Cap Table (Capitalization Table) is a detailed spreadsheet or tool that outlines a company’s ownership structure, including shares, equity percentages, investor stakes, and valuations. At Quickers Tech, we help you create and manage accurate, investor-friendly cap tables to maintain clarity as your startup grows.

3. When should a startup start building a cap table?

From day one. Even if you’re a solo founder, setting up a cap table early ensures you track every change in ownership from the start — which becomes crucial when raising funds, issuing options, or onboarding co-founders.

5. What happens to my cap table during a fundraising round?

Your cap table changes with each funding event. We model pre- and post-money scenarios, dilution impact, investor equity, and ownership percentages — so you're fully prepared before making decisions or signing term sheets.

7. How does having a clean cap table help during investor due diligence?

Investors want transparency. A clean, updated cap table built by Quickers Tech shows professionalism, clarity, and reduces delays during fundraising or acquisitions — boosting investor confidence.

9. Can I use Quickers Tech’s cap table services on a one-time basis?

Yes. Whether you need a one-time setup, cleanup, or a valuation event projection, we offer flexible services — and ongoing support if needed.

2. How does Quickers Tech help startups manage their cap tables?

We provide custom cap table setup, ongoing management, and updates with each funding round, employee option grant, or equity change. We ensure your records stay organized, compliant, and ready for investor review at any time.

4. Can Quickers Tech handle complex cap tables with multiple investors and SAFEs?

Yes. We’re experienced in handling complex structures involving: Convertible notes SAFEs Equity rounds (pre-seed to Series A+) Option pools We provide clear visuals and calculations that investors and founders can easily understand.

6. Can Quickers Tech help with employee stock option pools?

Absolutely. We help set up and manage employee equity plans, track vesting schedules, and calculate how they affect ownership — keeping both founders and team members informed and confident.

8. What tools or software does Quickers Tech use for cap table management?

We work with both custom spreadsheets and leading tools like Carta, Pulley, or Eqvista, depending on your budget, startup stage, and preferences. We also offer training and onboarding so you're in full control.

10. How can I get started with Cap Table management at Quickers Tech?

Contact us through our website and request a startup consultation. We’ll understand your structure, funding plans, and equity goals — then build a tailored cap table system that grows with your company.

Cap Table Services for Modern Startup Industries

Quickers builds lean, scalable, and AI-powered SaaS solutions for cap table management across multiple industries. We use generative AI, blockchain, and predictive analytics to improve ownership tracking, reduce equity-related errors, and prepare you for due diligence with confidence.