Enterprise Fraud Intelligence Platform

This platform transforms financial security by automating fraud detection through real-time transaction analysis. Integrating with core banking systems, this intelligence eliminated manual screening, driving a 71% reduction in fraud losses and achieving significant gains through operational efficiency.

Problem Statement

Financial institutions face escalating fraud losses and high false-positive rates from legacy rule-based systems, creating customer friction and significant revenue leakage across multiple business lines.

Goals

Reduce fraud loss rates below 2 basis points annually.

Improve legitimate transaction approvals to 99.5%.

Increase customer lifetime value by 25%.

Ensure transparency and regulatory compliance.

Product Overview

The Enterprise Fraud Intelligence Platform is a unified system for banks, providing tools required to detect fraud and optimize customer value. Users can process real-time streams, monitor behavior, and access insights. The system offers automated retraining and fairness audits for a secure experience including 24/7 detection and explainability.

With real-time scoring, adaptive thresholds, and integration options for financial teams, the platform ensures every transaction is safe and frictionless. Whether it’s managing credit cards, navigating regulatory exams, or enjoying a seamless banking experience, this platform is built to maximize customer retention and revenue for all institutions.

Responsibility

Tools

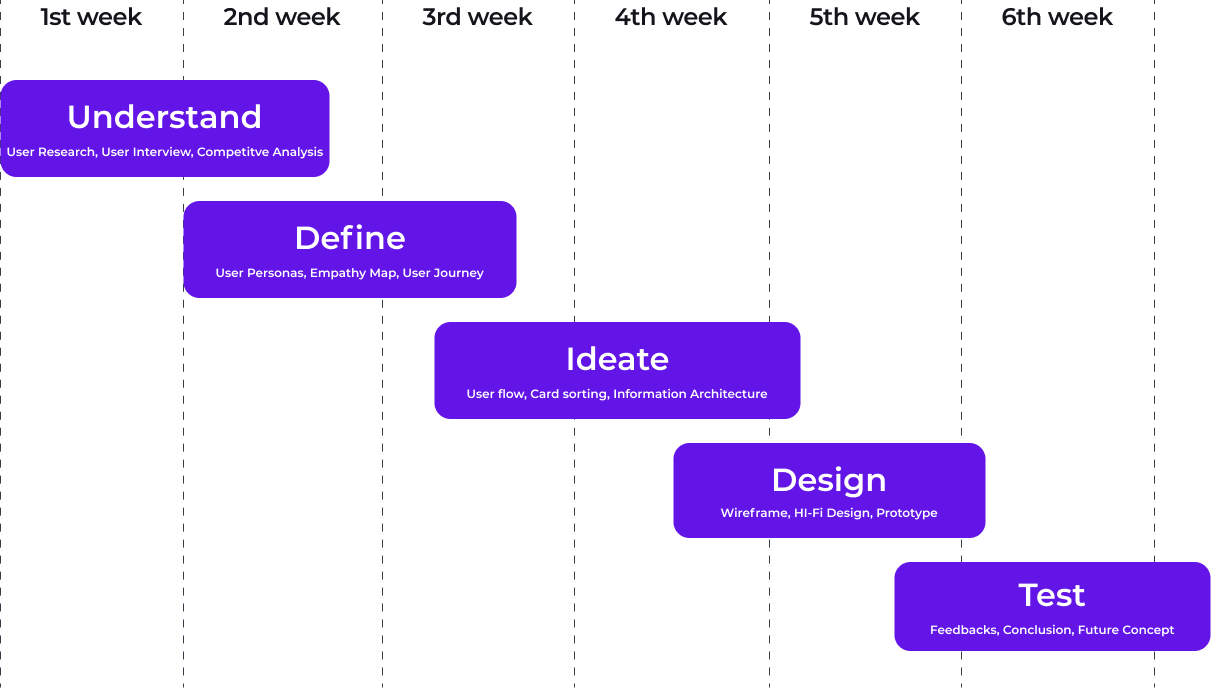

Design Process

The design process follows a structured approach: Understand user needs, define key features, ideate solutions, design the interface, and test for usability and performance. This ensures a user-centered, functional, and engaging app experience.

Understand

User Research

User Interview

Competitive Analysis

Define

User Personas

Empathy Map

User Journey

Ideate

Information Architecture

Design

Wireframe

Hi-FI Design

Prototype

Test

Feedbacks

Conclusion

Future Concept

Design Timeline

Target Audience

Retail banking customers and financial service users across multiple business lines (4.5M+ users).

Financial institutions and regional banks seeking real-time risk assessment and customer intelligence.

High-value customer segments interested in personalized financial offers, SME loans, and rewards.

Executive stakeholders (CROs, CDOs, CFOs) looking for automated fraud detection and AI-driven growth.

User Research

User research involved audits and assessments of legacy data and governance, revealing a need for integrated intelligence. Stakeholders prioritized fraud loss reduction, churn prediction, and model explainability. Real-time scoring and 24/7 monitoring were key requirements for enhancing detection accuracy and revenue.

Competitive Analysis

Traditional rule-based fraud systems lack integrated intelligence for real-time risk assessment, predictive analytics, and personalized intelligence. Competitors offer limited detection speed, missing the opportunity for automated retraining, explainable credit decisions, and a unified view of customer behavior.

Company Name

Rule-based System

Manual Audit

Basic ML App

Enterprise Intelligence

Labor Updates

Static rule sets

Labor reviews

Offline models

Real-time MLOps

Loyalty Programs

Personalized Content

Membership Management

AI-Powered Assistance

Training Resources

Subscription Services

Subscriptions

Unique Features

AI-driven intelligence provides real-time fraud scoring and personalized customer targeting for banking segments.

Unified feature store increases development speed with real-time data and automated model-to-production pipelines.

Explainable models enable stakeholders to access SHAP-based interpretability and transparent updates on credit decisions.

Premium subscription for advanced resources and specialized updates

Continuous MLOps unlocks operational savings and weekly retraining, reducing manual model updates significantly.

Quantitative Research

Our quantitative research for the Enterprise Fraud Intelligence project involved assessing data quality and lineage across legacy systems through audits and data analysis, focusing on functionalities like real-time scoring, fraud recall, CLV prediction, and operational efficiency.

Screeners

High-value customers segmented into 12 tiers for personalized offers and product propensity.

Individuals identified as churn risks 3–6 months in advance for targeted retention campaigns.

Users requiring transparent model explainability for credit decisions and regulatory compliance.

Institutions demanding real-time inference with less than 50ms latency for transaction authorization.

Cross-functional teams seeking a unified feature store to accelerate model-to-production cycles.

Key Findings

97%

Reduction in annual fraud loss realized within the first 12 months of deployment.

97%

Fraud recall achieved through ensemble model refinement and adaptive thresholds.

100%

Valued easy access to exclusive staff Fairness audit pass rate ensuring all models met FCRA/ECOA regulatory requirements.

22%

Increase in Customer Lifetime Value (CLV) for high-value segments within 6 months.

22%

Reduction in customer churn rate achieved via targeted retention pilot campaigns.

73%

Feature reuse rate across cross-functional teams, significantly improving development efficiency.

1. Customer Data Fragmentation

Banking institutions currently rely on legacy systems operating in silos for risk scoring and customer acquisition. This fragmented access to information creates blind spots, friction, and significant revenue leakage across business lines.

2. Lack of Personalized Intelligence

Existing rule-based models do not provide adaptive intelligence based on evolving patterns or specific transaction types. Critical updates or alerts are often generic, leading to high false-positives and failing to address individual behavioral signals.

3. Absence of Regulatory Clarity

There is a lack of structured digital tools that ensure explainability for denied credit decisions or fairness audits. Stakeholders want clearer advantages from automation, such as transparent model interpretability, 24/7 fraud monitoring, and real-time ROI.

User Persona: Internal Stakeholder

Name:

Carlos Martínez

Age:

42

EDUCATION:

Masters in Financial Risk Management

Job:

Train DriverSenior Risk Operations Manager

Location:

Madrid, Spain

HOBBIES:

Hiking through trails, reading history, and cyclingFamily time, travel

Bio

Carlos is a senior risk manager and an essential member of the bank’s security team who is committed to his financial practice. He manages real-time transaction streams across various departments and branches, necessitating that he stay informed regarding fraud tactics, regulatory protocols, and performance updates.

Personality

Responsible

Committed

Detail-oriented

Safety-focused

Pain Points

Difficulty staying updated with constant changes to fraud tactics and emerging risk patterns.

Struggles to access unified customer information across different legacy banking silos.

Desires more direct, transparent, and faster model explainability for denied credit decisions.

Goal

Maintain real-time awareness of fraud loss rates and legitimate transaction approval benchmarks.

Improve time management through enhanced automated retraining and AI-driven detection clarity.

Rely on robust enterprise automation for risk representation and customer asset protection.

User Persona: Operational Lead

Name:

Elena Rodriguez

Age:

42

EDUCATION:

Advanced Strategic Digital Management

Job:

Head of Customer Intelligence

Location:

Madrid, Spain

HOBBIES:

Strategy gaming, hiking with family, volunteering

Bio

Elena is an experienced digital strategist and a coordinator who is committed to her financial institution. She manages complex customer lifecycles across different segments and products, requiring her to stay informed about churn risks, product propensity, and operational updates.

Personality

Responsible

Committed

Detail-oriented

Safety-focused

Pain Points

Difficulty staying updated with manual churn predictions and fragmented customer data availability.

Struggles to access consolidated behavioral information across different retail medical-finance units.

Goal

Stay informed about customer lifetime value shifts and professional segment management.

Improve administrative balance through better MLOps pipeline clarity and feature reuse.

Rely on strong AI support for seamless predictive modeling and proactive churn protection.

User Journey Map

Persona: Carlos Martínez (Senior Risk Operations Manager)

Actions

Action 1

Action 2

Action 3

Action 4

Task List

Monitor real-time fraud scoring streams.

Review high-value transaction alerts.

Access model explainability reports.

Subscribe to model drift notifications.

Feeling

Vigilant about detection accuracy.

Focused on immediate risk mitigation.

Confident in decision transparency.

Prepared for emerging fraud tactics.

Thoughts

Is the ensemble model catching 95%+ of fraud?

These false positives are significantly down.

SHAP values help justify these denials.

I need to ensure models don't go stale.

Improvement Opportunities

Automate more feature engineering.

Integrate deeper graph network views.

Streamline regulatory audit exports.

Schedule weekly retraining cycles.

Actions : Action 1

Task List

Analyze customer churn risk cohorts

Feeling

Review personalized offer campaigns

Thoughts

Access unified customer profiles

Improvement Opportunities

Monitor CLV lift benchmarks

Actions : Action 2

Task List

Review high-value transaction alerts.

Feeling

Focused on immediate risk mitigation.

Thoughts

These false positives are significantly down.

Improvement Opportunities

Integrate deeper graph network views.

Actions : Action 3

Task List

Access model explainability reports.

Feeling

Confident in decision transparency.

Thoughts

SHAP values help justify these denials.

Improvement Opportunities

Streamline regulatory audit exports.

Actions : Action 4

Task List

Monitor CLV lift benchmarks

Feeling

Strategic about revenue growth

Thoughts

AI is definitely improving our ROI

Improvement Opportunities

Implement automated A/B testing

User Journey Map

Persona: Carlos Martínez (Senior Risk Operations Manager)

Actions

Action 1

Action 2

Action 3

Action 4

Task List

Monitor real-time fraud scoring streams.

Review high-value transaction alerts.

Access model explainability reports.

Subscribe to model drift notifications.

Feeling

Vigilant about detection accuracy.

Focused on immediate risk mitigation.

Confident in decision transparency.

Prepared for emerging fraud tactics.

Thoughts

Is the ensemble model catching 95%+ of fraud?

These false positives are significantly down.

SHAP values help justify these denials.

I need to ensure models don't go stale.

Improvement Opportunities

Automate more feature engineering.

Integrate deeper graph network views.

Streamline regulatory audit exports.

Schedule weekly retraining cycles.

Actions : Action 1

Task List

Analyze customer churn risk cohorts

Feeling

Review personalized offer campaigns

Thoughts

Access unified customer profiles

Improvement Opportunities

Monitor CLV lift benchmarks

Actions : Action 2

Task List

Review high-value transaction alerts.

Feeling

Focused on immediate risk mitigation.

Thoughts

These false positives are significantly down.

Improvement Opportunities

Integrate deeper graph network views.

Actions : Action 3

Task List

Access model explainability reports.

Feeling

Confident in decision transparency.

Thoughts

SHAP values help justify these denials.

Improvement Opportunities

Streamline regulatory audit exports.

Actions : Action 4

Task List

Monitor CLV lift benchmarks

Feeling

Strategic about revenue growth

Thoughts

AI is definitely improving our ROI

Improvement Opportunities

Implement automated A/B testing

Key Takeaways

The Railway Workforce Portal centralizes the employee experience by combining training registration, labor tracking, workforce resources, benefits management, and member rewards in one platform. Research confirms strong demand for a unified system that replaces fragmented communication channels. Personalized updates, safety alerts, regulatory guidance, and AI-assisted support reduce friction and improve participation. The platform supports multiple personas—from junior recruits to experienced staff—ensuring inclusivity, engagement, and a more connected railway workforce.