Table of Contents

Quickers: AI-Powered Digital Marketplace

Introduction

Overview: Quickers is an AI-powered digital marketplace designed for downstream Oil & Gas MRO and Turnaround operations. It replaces manual, fragmented procurement with an intelligent buy-and-sell platform.

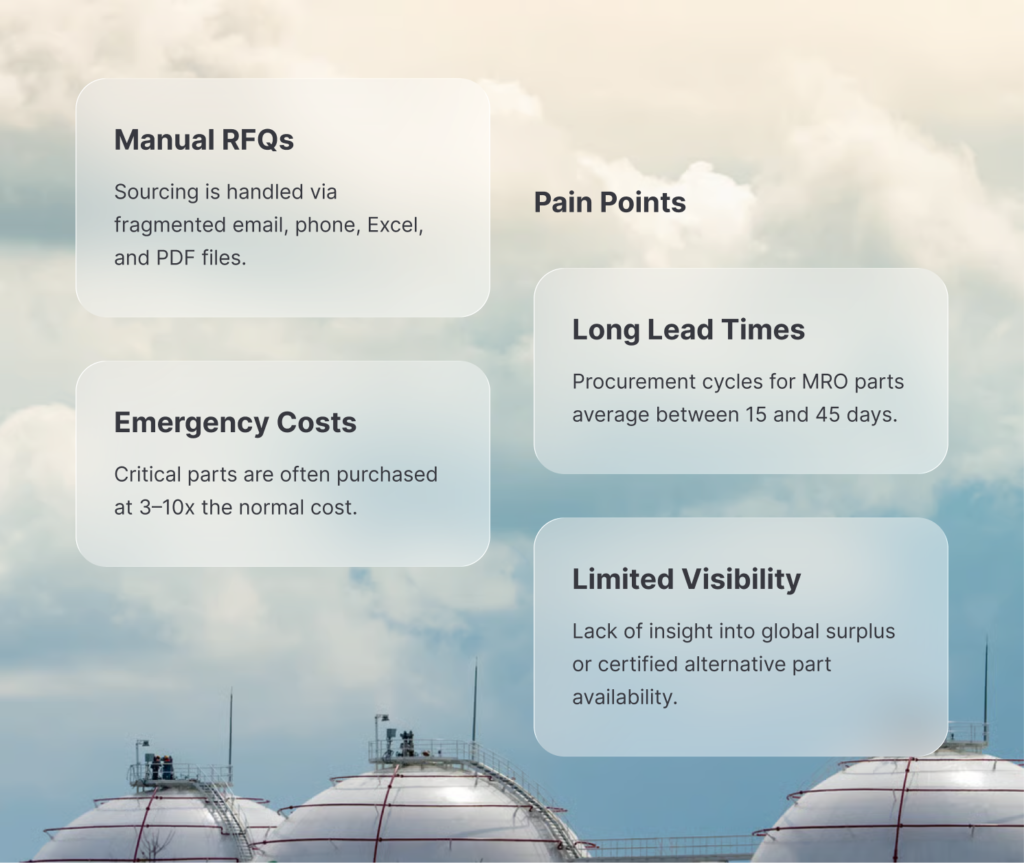

Project background: The downstream industry faces manual RFQs, long lead times, and emergency purchases costing 3–10x the normal rate. These inefficiencies cause downtime, safety risks, and poor capital discipline.

What you’ll cover: This case study explores how Quickers utilizes AI part matching and digital RFQs to reduce OPEX, optimize inventory, and minimize critical outage delays across refinery sites

Objectives

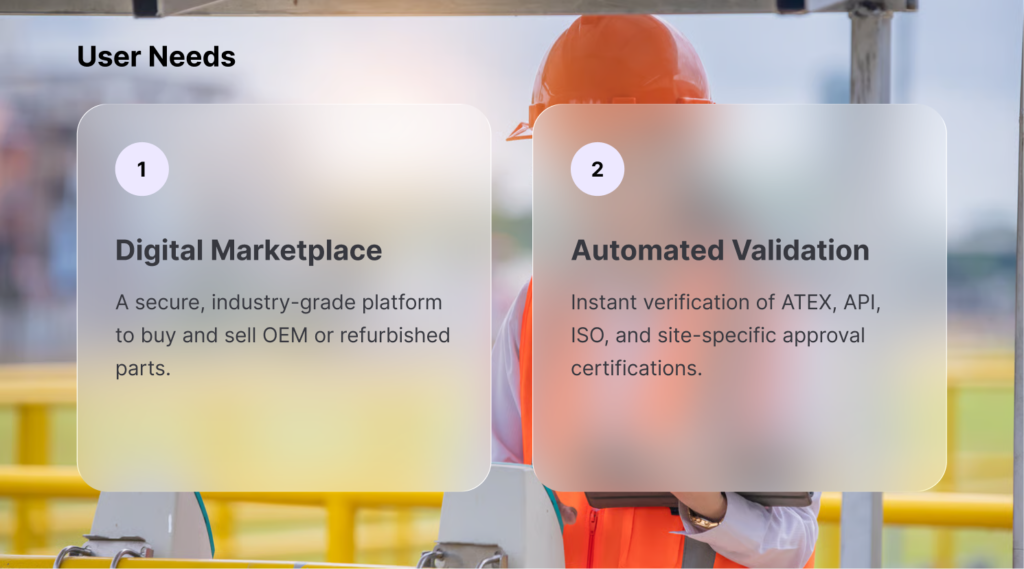

The objective was to transition procurement from paper-based cycles to a secure, real-time digital market. We aimed to eliminate manual effort and reduce single-vendor dependency.

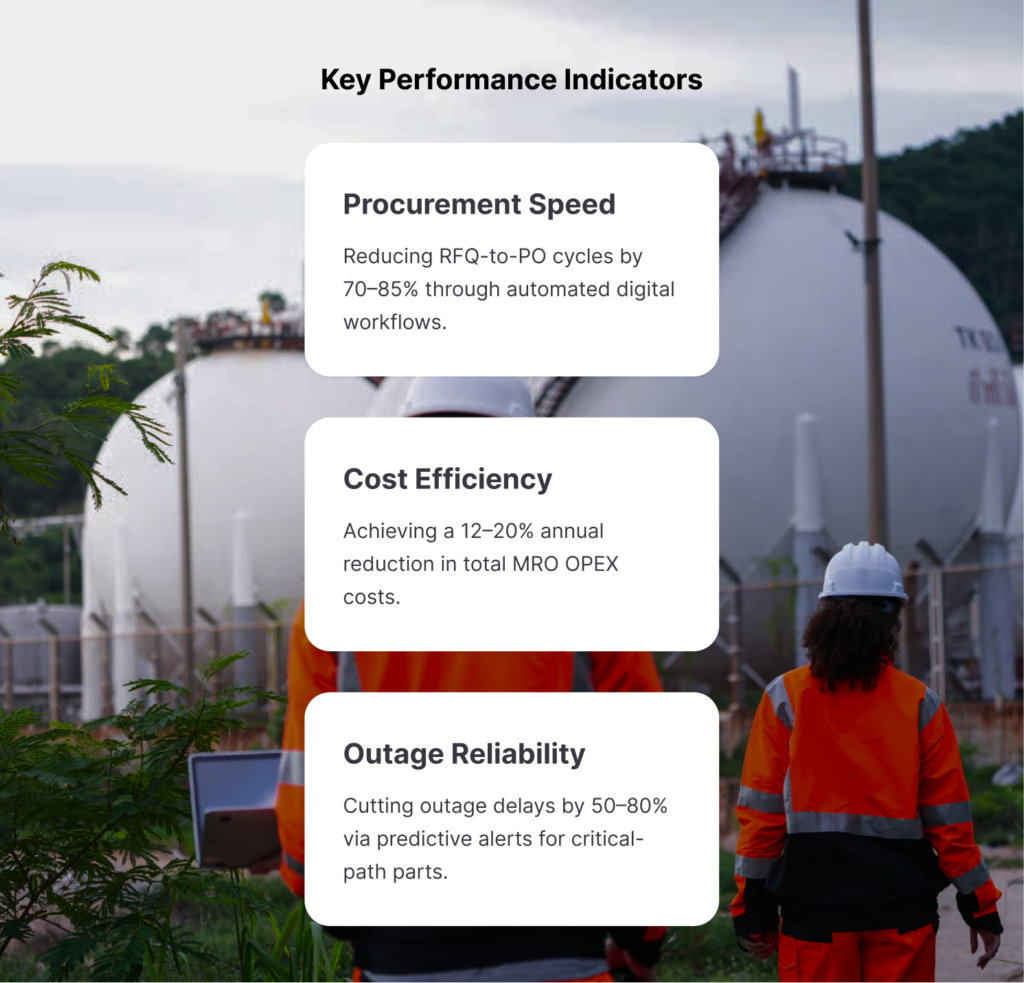

Success is measured by procurement cycle time reduction, total OPEX savings, and outage performance. These KPIs quantify the financial impact and operational resilience of the platform.

Research Goals & Methods

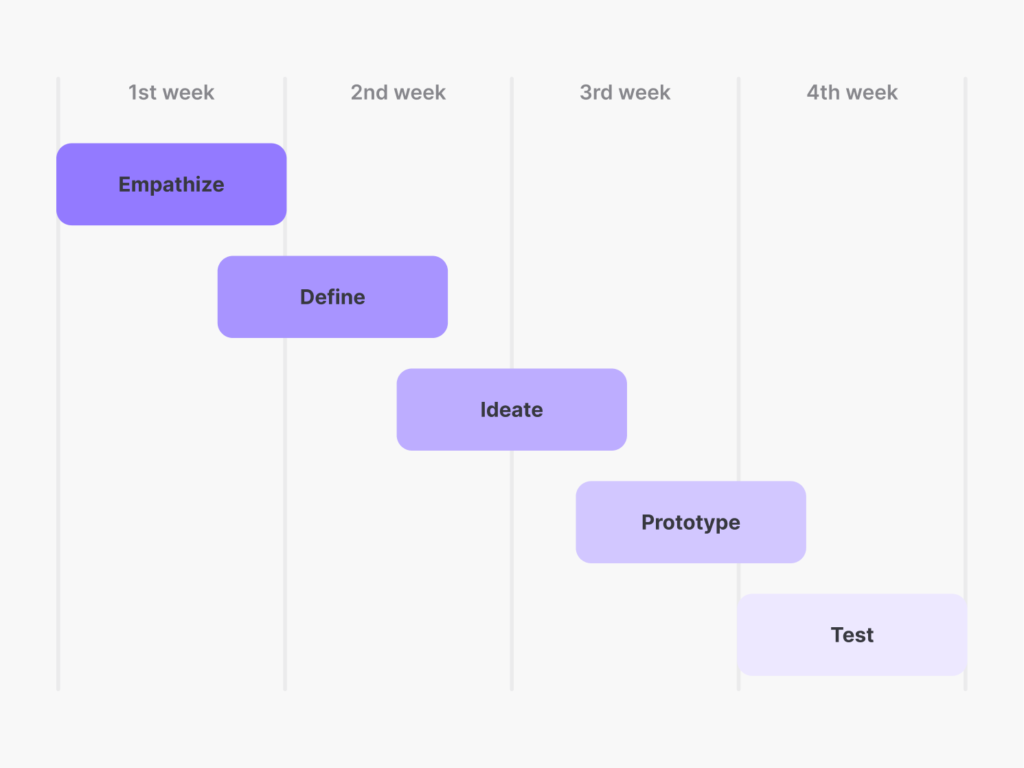

Research is a fundamental phase of industrial digital transformation. It establishes the baseline for mapping procurement cycles, auditing supply chain inefficiencies, and optimizing AI part-matching. This stage involves defining strategic research objectives, analyzing ERP datasets, and uncovering operational insights.

Understand user needs:

Determine the specific requirements of procurement managers, including their sourcing preferences, reliability needs, and technical certification motivations.

Gather feedback:

Determine the specific requirements of procurement managers, including their sourcing preferences, reliability needs, and technical certification motivations.

Explain research methods:

Detail the process for gathering technical feedback from refinery operators regarding platform integration and site-specific approval rules.

Identify pain points:

Utilize deep-dive ERP data audits, stakeholder interviews, and supply chain mapping. These methods provide quantitative evidence for reducing MRO OPEX and downtime.

Detail your findings:

Highlight the key discovery: emergency purchases cost 3–10x more due to a complete lack of digital marketplace transparency.

Empathy map

Says

“Manual RFQs are far too slow for critical-path components during a refinery turnaround.”

“We are over-reliant on single-vendor OEM contracts, which inflates our emergency spending.”

“I need a way to monetize our dead stock and surplus inventory instead of letting it sit idle.”

“Is there a way to verify ATEX and ISO certifications automatically without chasing paper?”

Thinks

I believe we are paying 3–10x too much for emergency parts lack of market transparency.

If I could reduce the RFQ-to-PO cycle by 70%, I could significantly lower the risk of outage.

Our current inventory data in SAP is fragmented; we likely have the parts we need at another site.

Digital transformation is no longer optional; we need capital discipline to stay competitive.

Spends 6–10 hours of manual effort per purchase order tracking emails, PDFs, and Excel sheets.

Manages high-pressure communications between maintenance engineers and global suppliers.

Cross-references legacy catalogs manually to find interchangeable parts or alternatives.

Navigates complex, paper-based approval workflows for every critical spare acquisition.

Does

Frustrated by the 15–45 day lead times for parts that should be available locally.

Anxious about the financial impact of refinery downtime, where one day costs €1–3M.

Overwhelmed by the volume of duplicate stock (20–35%) across different refinery locations.

Motivated to achieve the 12–20% annual OPEX reduction targets set by leadership.

Feels

Company

Traditional Manual

OEM-Only Sourcing

Quickers Platform

AI Part Matching

Digital Audit Trail

Surplus Resale

ERP Integration

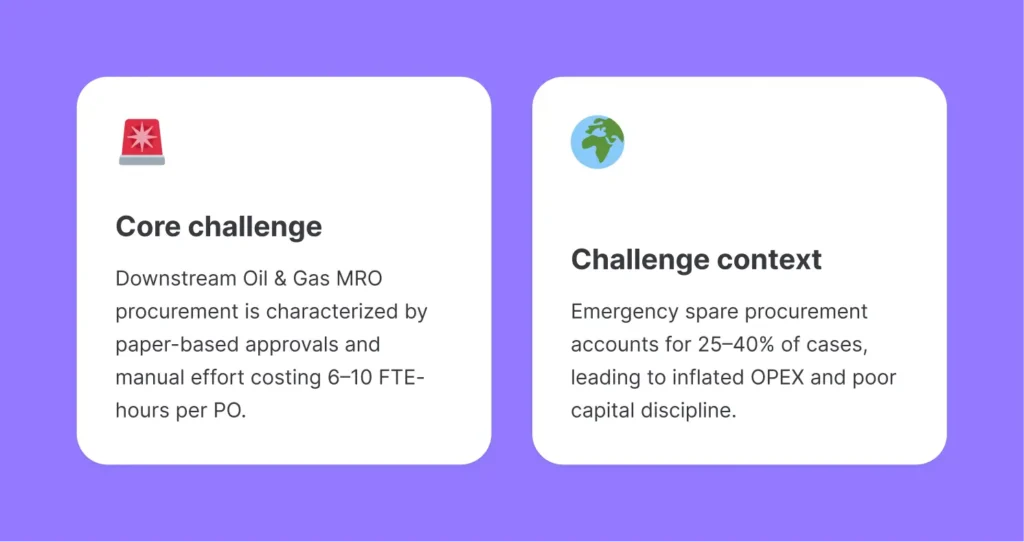

Step 4: Define the Core Challenge

Defining the problem ensures our solution targets the root causes of refinery downtime rather than just automating existing, inefficient manual procurement processes.

The issue: Fragmented, paper-based MRO procurement leads to excessive 15–45 day RFQ cycles, creating severe operational risks and inflating annual maintenance costs significantly.

Provide context: Large refineries suffer from a 30–60% price variance for identical parts due to a lack of global visibility and reliance on single-vendor OEM contracts.

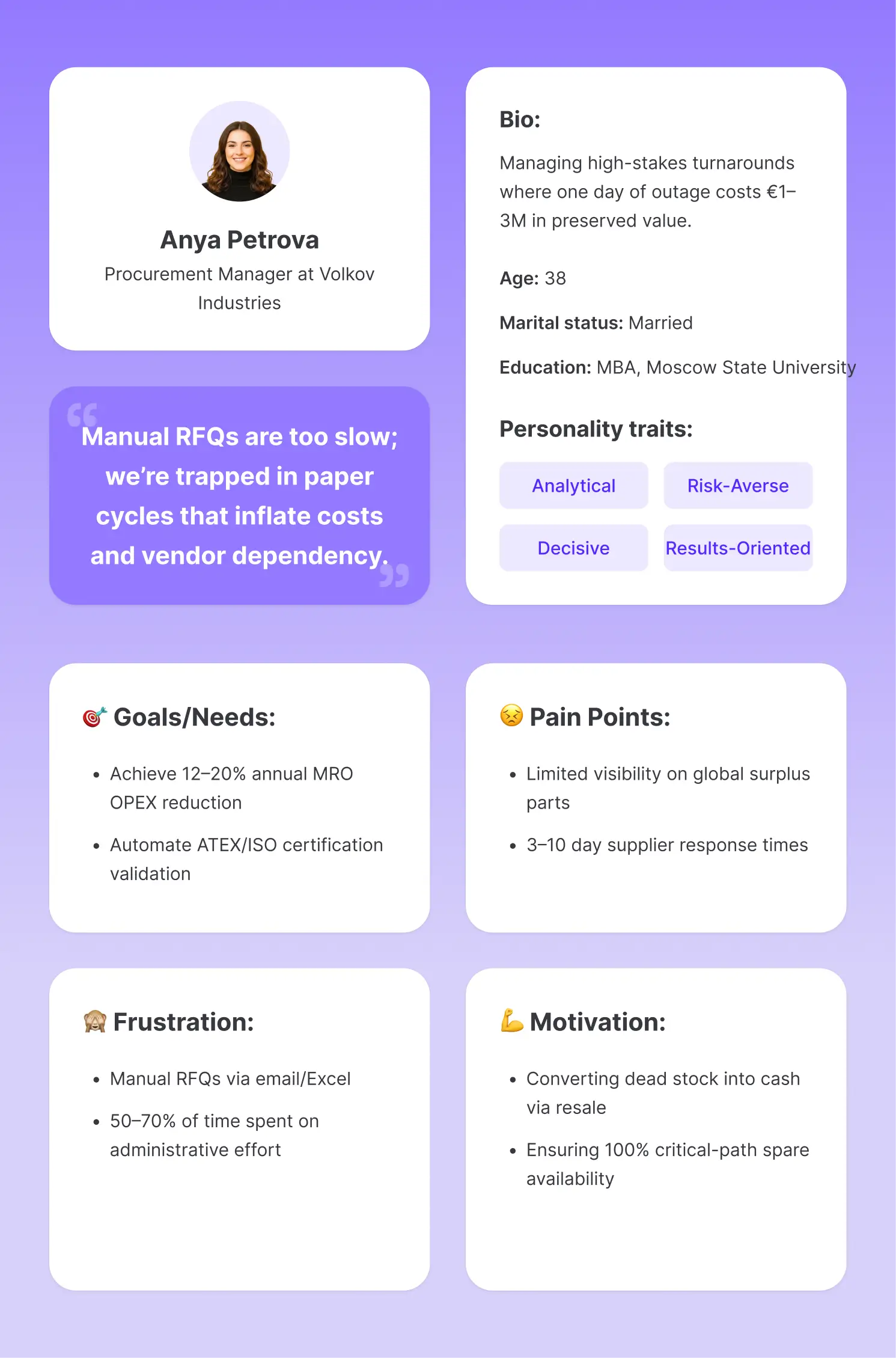

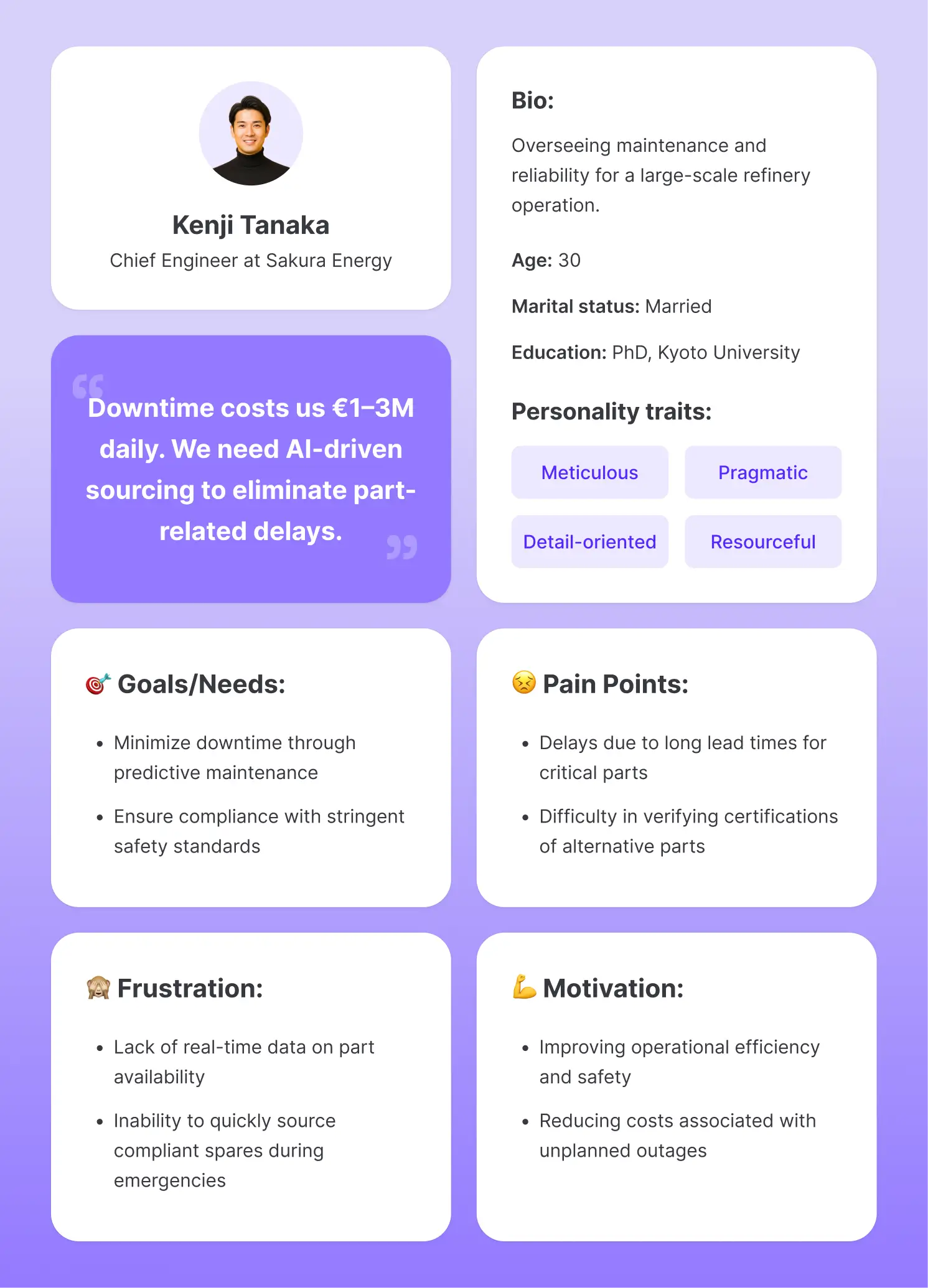

Your Users Persona

The ecosystem is essential for building a marketplace that meets complex industrial certification needs and high-stakes operational demands effectively.

Target users: Primary users include refinery procurement teams, maintenance leads, and EPC contractors who manage critical spare parts and complex turnaround schedules.

Personas: We developed personas representing technical buyers focused on capital discipline and maintenance managers aiming to eliminate outage delays through AI-driven sourcing.

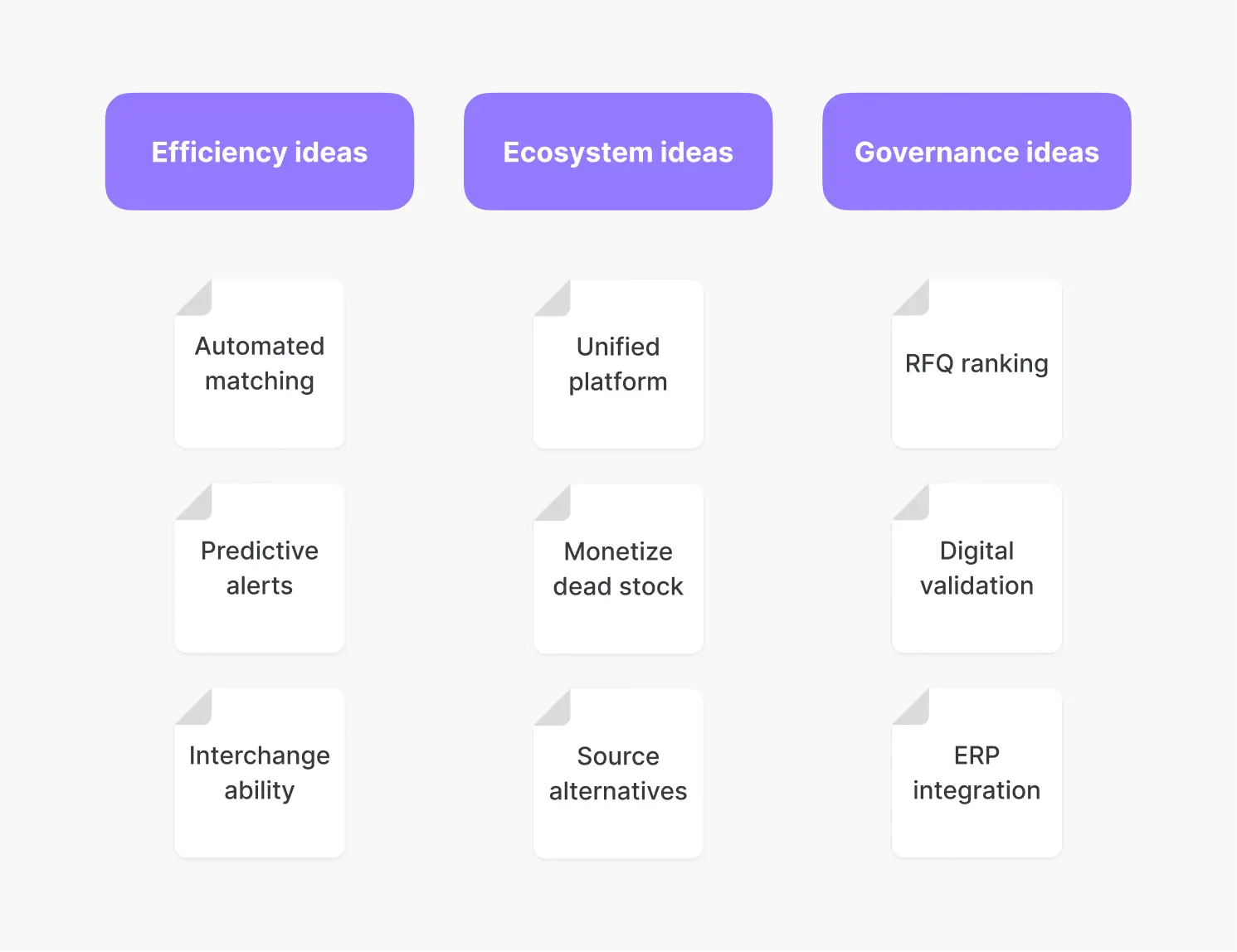

Solutions

Brainstorming allowed us to transition from manual workflows to an AI-driven ecosystem. We focused on features that maximize supply resilience and monetize underutilized inventory.

Ideation techniques: We utilized value-stream mapping to identify automation opportunities within the RFQ-to-PO cycle, focusing on AI matching to replace manual PDF searches.

Generate and share ideas: Present the initial ideas that emerged during brainstorming sessions. This can include rough sketches, mind maps, or notes from whiteboard sessions.

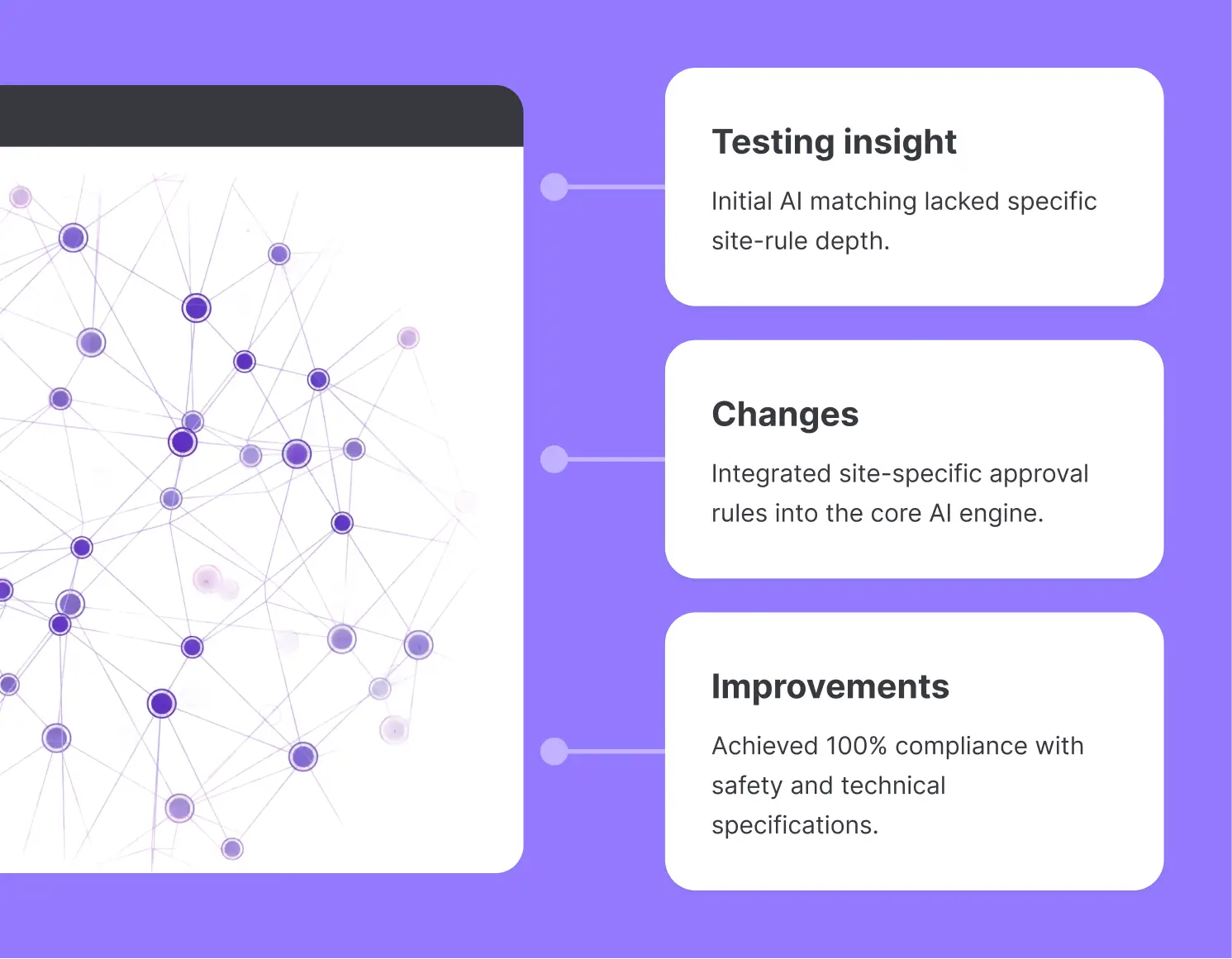

Testing and Iteration

Pilot testing at refinery sites provided the data needed for iterative optimization. These insights demonstrate how the platform was refined to improve maintenance workflows.

Testing insights: Pilot testing at refinery sites confirmed that AI-driven part matching accurately identifies substitutes, reducing the dependency on high-cost OEM emergency orders.

Detail refinements: We refined the ERP integration module for SAP and Maximo to ensure seamless data flow, eliminating 6–10 hours of manual administrative effort per PO.

Conclusions & Key Takeaways

Implementing the Quickers marketplace transforms downstream MRO from a manual cost center into a strategic asset. By achieving a 12–20% OPEX reduction and preserving €1–3M in value daily during outages, this solution ensures long-term capital discipline, safety compliance, and operational excellence across the global Oil & Gas supply chain.